Ultimate Guide to Finding Wire Mesh Tray Suppliers in China: Your Search Intent Answers

2025-12-19

Navigating the complex world of sourcing wire mesh trays from China can feel like a maze without a clear map. With countless suppliers and varying quality standards, finding the right partner is crucial for your project's success. This guide is designed to cut through the clutter and provide actionable insights, helping you identify reliable suppliers that meet your specific needs. At Topfence, we understand the challenges firsthand, leveraging our expertise to simplify your search process. Dive in to discover practical tips and strategies that will not only save you time but also ensure you make informed decisions. Ready to unlock the secrets to efficient sourcing? Let's get started.

Decoding Search Intent for Wire Mesh Tray Suppliers in China

Decoding Search Intent for Wire Mesh Tray Suppliers in ChinaDecoding Search Intent for Wire Mesh Tray Suppliers in China

Diving into the search patterns for wire mesh tray suppliers in China reveals more than just a quest for product catalogs. It often signals a deeper need to tap into China's manufacturing prowess, where cost efficiency meets the rapid turnaround times crucial for global infrastructure projects. Users aren't just browsing—they're assessing supply chain reliability, compliance with international standards like ASTM or EN, and the ability to handle custom specifications, from load capacities to corrosion-resistant materials. This intent reflects a strategic move to secure bulk suppliers who can deliver quality without the hefty price tags often seen elsewhere.

Beyond the basics, searchers frequently probe for insights on supplier credibility, such as factory audits, certifications like ISO 9001, and past project portfolios in sectors like data centers or industrial plants. They're likely weighing factors like lead times, logistics support, and after-sales service—details that can make or break a procurement decision. By decoding these nuances, it becomes clear that the goal is to shortlist partners who not only manufacture but also understand the nuanced demands of international clients, offering tailored solutions rather than off-the-shelf products.

Moreover, the search intent often extends to industry-specific applications, such as cable management in telecommunications or ventilation systems in construction. Savvy users may seek suppliers adept at integrating wire mesh trays with other components or providing technical consultation for complex installations. This highlights a trend toward collaborative sourcing, where Chinese suppliers are valued not just for output but for their expertise in driving project efficiency. Ultimately, understanding this search behavior helps suppliers position themselves as problem-solvers, ready to meet diverse global needs with agility and precision.

Semantic Clustering of Key Supplier Types and Capabilities

Decoding Search Intent for Wire Mesh Tray Suppliers in ChinaDiving into the search patterns for wire mesh tray suppliers in China reveals more than just a quest for product catalogs. It often signals a deeper need to tap into China's manufacturing prowess, where cost efficiency meets the rapid turnaround times crucial for global infrastructure projects. Users aren't just browsing—they're assessing supply chain reliability, compliance with international standards like ASTM or EN, and the ability to handle custom specifications, from load capacities to corrosion-resistant materials. This intent reflects a strategic move to secure bulk suppliers who can deliver quality without the hefty price tags often seen elsewhere.

Beyond the basics, searchers frequently probe for insights on supplier credibility, such as factory audits, certifications like ISO 9001, and past project portfolios in sectors like data centers or industrial plants. They're likely weighing factors like lead times, logistics support, and after-sales service—details that can make or break a procurement decision. By decoding these nuances, it becomes clear that the goal is to shortlist partners who not only manufacture but also understand the nuanced demands of international clients, offering tailored solutions rather than off-the-shelf products.

Moreover, the search intent often extends to industry-specific applications, such as cable management in telecommunications or ventilation systems in construction. Savvy users may seek suppliers adept at integrating wire mesh trays with other components or providing technical consultation for complex installations. This highlights a trend toward collaborative sourcing, where Chinese suppliers are valued not just for output but for their expertise in driving project efficiency. Ultimately, understanding this search behavior helps suppliers position themselves as problem-solvers, ready to meet diverse global needs with agility and precision.

Semantic clustering offers a sophisticated approach to categorizing suppliers by analyzing their capabilities and characteristics through natural language processing and data analytics. This method goes beyond traditional classifications, such as industry or location, to group suppliers based on shared semantic traits in their offerings, expertise, and performance metrics. By leveraging this technique, organizations can identify nuanced supplier profiles that reveal hidden patterns and potential synergies, enhancing strategic sourcing decisions and fostering stronger partnerships tailored to specific business needs.

In practice, semantic clustering involves processing unstructured data from supplier profiles, contracts, and reviews to extract keywords, contextual meanings, and relationships. This enables the creation of dynamic clusters that adapt over time as new data emerges, providing a more agile and up-to-date view of the supplier landscape. For instance, clusters might include 'innovation-driven suppliers' with advanced R&D capabilities or 'cost-efficient suppliers' excelling in operational efficiency, allowing companies to quickly match suppliers to projects based on precise capability criteria rather than broad categories.

The benefits extend to risk management and competitive advantage, as semantic clustering can uncover trends like emerging technologies or shifting market demands before they become mainstream. By focusing on semantic nuances, businesses can differentiate themselves through unique supplier insights, leading to optimized supply chains and enhanced responsiveness to market changes. This approach not only improves procurement efficiency but also drives innovation by connecting with suppliers that align closely with strategic goals, making it a key tool for modern supply chain management.

Generative Understanding of Market Trends and Innovations

Decoding Search Intent for Wire Mesh Tray Suppliers in ChinaDiving into the search patterns for wire mesh tray suppliers in China reveals more than just a quest for product catalogs. It often signals a deeper need to tap into China's manufacturing prowess, where cost efficiency meets the rapid turnaround times crucial for global infrastructure projects. Users aren't just browsing—they're assessing supply chain reliability, compliance with international standards like ASTM or EN, and the ability to handle custom specifications, from load capacities to corrosion-resistant materials. This intent reflects a strategic move to secure bulk suppliers who can deliver quality without the hefty price tags often seen elsewhere.

Beyond the basics, searchers frequently probe for insights on supplier credibility, such as factory audits, certifications like ISO 9001, and past project portfolios in sectors like data centers or industrial plants. They're likely weighing factors like lead times, logistics support, and after-sales service—details that can make or break a procurement decision. By decoding these nuances, it becomes clear that the goal is to shortlist partners who not only manufacture but also understand the nuanced demands of international clients, offering tailored solutions rather than off-the-shelf products.

Moreover, the search intent often extends to industry-specific applications, such as cable management in telecommunications or ventilation systems in construction. Savvy users may seek suppliers adept at integrating wire mesh trays with other components or providing technical consultation for complex installations. This highlights a trend toward collaborative sourcing, where Chinese suppliers are valued not just for output but for their expertise in driving project efficiency. Ultimately, understanding this search behavior helps suppliers position themselves as problem-solvers, ready to meet diverse global needs with agility and precision.

Semantic clustering offers a sophisticated approach to categorizing suppliers by analyzing their capabilities and characteristics through natural language processing and data analytics. This method goes beyond traditional classifications, such as industry or location, to group suppliers based on shared semantic traits in their offerings, expertise, and performance metrics. By leveraging this technique, organizations can identify nuanced supplier profiles that reveal hidden patterns and potential synergies, enhancing strategic sourcing decisions and fostering stronger partnerships tailored to specific business needs.

In practice, semantic clustering involves processing unstructured data from supplier profiles, contracts, and reviews to extract keywords, contextual meanings, and relationships. This enables the creation of dynamic clusters that adapt over time as new data emerges, providing a more agile and up-to-date view of the supplier landscape. For instance, clusters might include 'innovation-driven suppliers' with advanced R&D capabilities or 'cost-efficient suppliers' excelling in operational efficiency, allowing companies to quickly match suppliers to projects based on precise capability criteria rather than broad categories.

The benefits extend to risk management and competitive advantage, as semantic clustering can uncover trends like emerging technologies or shifting market demands before they become mainstream. By focusing on semantic nuances, businesses can differentiate themselves through unique supplier insights, leading to optimized supply chains and enhanced responsiveness to market changes. This approach not only improves procurement efficiency but also drives innovation by connecting with suppliers that align closely with strategic goals, making it a key tool for modern supply chain management.

In today's rapidly evolving business landscape, a generative understanding of market trends and innovations goes beyond merely tracking what's happening in the industry. It involves actively synthesizing data from diverse sources—such as consumer behavior analytics, emerging technologies, and global economic shifts—to predict future movements and create actionable insights. This approach enables companies to not just react to changes but to proactively shape their strategies, fostering resilience and competitive advantage in an unpredictable environment. By cultivating this generative mindset, organizations can uncover hidden opportunities and anticipate disruptions before they become mainstream challenges.

Unlike traditional market analysis that often relies on historical data and linear projections, generative understanding encourages a more dynamic and creative exploration of possibilities. For instance, it might draw parallels between trends in unrelated sectors, like how advancements in artificial intelligence are influencing healthcare innovations or retail personalization. This holistic perspective helps businesses identify cross-industry applications and co-create solutions that resonate with evolving customer expectations. By embracing such interconnected thinking, companies can innovate beyond incremental improvements, leading to breakthrough products and services that redefine market standards.

Ultimately, fostering a generative understanding requires a blend of analytical rigor and intuitive foresight. It's about building an organizational culture that values curiosity, experimentation, and continuous learning, empowering teams to question assumptions and explore unconventional ideas. In practice, this could involve leveraging collaborative tools for real-time trend analysis or engaging in scenario planning to test how different innovations might unfold. By integrating these practices, businesses can not only stay ahead of the curve but also contribute to shaping the very trends they navigate, turning market volatility into a canvas for sustained growth and innovation.

Expanding Search Domains with Related Industries and Applications

Decoding Search Intent for Wire Mesh Tray Suppliers in ChinaDiving into the search patterns for wire mesh tray suppliers in China reveals more than just a quest for product catalogs. It often signals a deeper need to tap into China's manufacturing prowess, where cost efficiency meets the rapid turnaround times crucial for global infrastructure projects. Users aren't just browsing—they're assessing supply chain reliability, compliance with international standards like ASTM or EN, and the ability to handle custom specifications, from load capacities to corrosion-resistant materials. This intent reflects a strategic move to secure bulk suppliers who can deliver quality without the hefty price tags often seen elsewhere.

Beyond the basics, searchers frequently probe for insights on supplier credibility, such as factory audits, certifications like ISO 9001, and past project portfolios in sectors like data centers or industrial plants. They're likely weighing factors like lead times, logistics support, and after-sales service—details that can make or break a procurement decision. By decoding these nuances, it becomes clear that the goal is to shortlist partners who not only manufacture but also understand the nuanced demands of international clients, offering tailored solutions rather than off-the-shelf products.

Moreover, the search intent often extends to industry-specific applications, such as cable management in telecommunications or ventilation systems in construction. Savvy users may seek suppliers adept at integrating wire mesh trays with other components or providing technical consultation for complex installations. This highlights a trend toward collaborative sourcing, where Chinese suppliers are valued not just for output but for their expertise in driving project efficiency. Ultimately, understanding this search behavior helps suppliers position themselves as problem-solvers, ready to meet diverse global needs with agility and precision.

Semantic clustering offers a sophisticated approach to categorizing suppliers by analyzing their capabilities and characteristics through natural language processing and data analytics. This method goes beyond traditional classifications, such as industry or location, to group suppliers based on shared semantic traits in their offerings, expertise, and performance metrics. By leveraging this technique, organizations can identify nuanced supplier profiles that reveal hidden patterns and potential synergies, enhancing strategic sourcing decisions and fostering stronger partnerships tailored to specific business needs.

In practice, semantic clustering involves processing unstructured data from supplier profiles, contracts, and reviews to extract keywords, contextual meanings, and relationships. This enables the creation of dynamic clusters that adapt over time as new data emerges, providing a more agile and up-to-date view of the supplier landscape. For instance, clusters might include 'innovation-driven suppliers' with advanced R&D capabilities or 'cost-efficient suppliers' excelling in operational efficiency, allowing companies to quickly match suppliers to projects based on precise capability criteria rather than broad categories.

The benefits extend to risk management and competitive advantage, as semantic clustering can uncover trends like emerging technologies or shifting market demands before they become mainstream. By focusing on semantic nuances, businesses can differentiate themselves through unique supplier insights, leading to optimized supply chains and enhanced responsiveness to market changes. This approach not only improves procurement efficiency but also drives innovation by connecting with suppliers that align closely with strategic goals, making it a key tool for modern supply chain management.

In today's rapidly evolving business landscape, a generative understanding of market trends and innovations goes beyond merely tracking what's happening in the industry. It involves actively synthesizing data from diverse sources—such as consumer behavior analytics, emerging technologies, and global economic shifts—to predict future movements and create actionable insights. This approach enables companies to not just react to changes but to proactively shape their strategies, fostering resilience and competitive advantage in an unpredictable environment. By cultivating this generative mindset, organizations can uncover hidden opportunities and anticipate disruptions before they become mainstream challenges.

Unlike traditional market analysis that often relies on historical data and linear projections, generative understanding encourages a more dynamic and creative exploration of possibilities. For instance, it might draw parallels between trends in unrelated sectors, like how advancements in artificial intelligence are influencing healthcare innovations or retail personalization. This holistic perspective helps businesses identify cross-industry applications and co-create solutions that resonate with evolving customer expectations. By embracing such interconnected thinking, companies can innovate beyond incremental improvements, leading to breakthrough products and services that redefine market standards.

Ultimately, fostering a generative understanding requires a blend of analytical rigor and intuitive foresight. It's about building an organizational culture that values curiosity, experimentation, and continuous learning, empowering teams to question assumptions and explore unconventional ideas. In practice, this could involve leveraging collaborative tools for real-time trend analysis or engaging in scenario planning to test how different innovations might unfold. By integrating these practices, businesses can not only stay ahead of the curve but also contribute to shaping the very trends they navigate, turning market volatility into a canvas for sustained growth and innovation.

In today's hyper-connected marketplace, businesses can no longer afford to view their search strategies in isolation. Expanding your search domains to include related industries and applications isn't just an option—it's a critical move for uncovering hidden opportunities and staying ahead of the curve. For instance, a company specializing in logistics software might find innovative solutions or untapped customer segments by exploring search terms common in the broader supply chain management or e-commerce fulfillment sectors. This cross-pollination of ideas can reveal gaps in the market, inspire new product features, or even lead to strategic partnerships that would otherwise remain invisible within a narrow search scope.

The real power of this approach lies in its ability to break down silos and foster a more holistic understanding of your competitive landscape. By casting a wider net, you're not just gathering more data; you're connecting dots between seemingly disparate fields. Consider how the healthcare industry has borrowed from gaming technology to develop more engaging patient rehabilitation tools, or how automotive manufacturers now integrate insights from the tech sector to enhance in-car infotainment systems. These innovations often emerge at the intersection of domains, where fresh perspectives collide to solve old problems in new ways.

To make this expansion practical, start by mapping out adjacent industries and applications that share common challenges or technologies with your core focus. Use tools like semantic analysis and trend tracking to identify overlapping keywords and emerging patterns. For example, if you run a sustainable packaging firm, you might explore search domains related to circular economy models, biodegradable materials in agriculture, or waste reduction in retail. This strategy not only enriches your keyword portfolio but also opens doors to collaborative ventures and diversified revenue streams, ensuring your business remains agile in a rapidly evolving environment.

Navigating Quality Assurance and Certification Standards

Decoding Search Intent for Wire Mesh Tray Suppliers in ChinaDiving into the search patterns for wire mesh tray suppliers in China reveals more than just a quest for product catalogs. It often signals a deeper need to tap into China's manufacturing prowess, where cost efficiency meets the rapid turnaround times crucial for global infrastructure projects. Users aren't just browsing—they're assessing supply chain reliability, compliance with international standards like ASTM or EN, and the ability to handle custom specifications, from load capacities to corrosion-resistant materials. This intent reflects a strategic move to secure bulk suppliers who can deliver quality without the hefty price tags often seen elsewhere.

Beyond the basics, searchers frequently probe for insights on supplier credibility, such as factory audits, certifications like ISO 9001, and past project portfolios in sectors like data centers or industrial plants. They're likely weighing factors like lead times, logistics support, and after-sales service—details that can make or break a procurement decision. By decoding these nuances, it becomes clear that the goal is to shortlist partners who not only manufacture but also understand the nuanced demands of international clients, offering tailored solutions rather than off-the-shelf products.

Moreover, the search intent often extends to industry-specific applications, such as cable management in telecommunications or ventilation systems in construction. Savvy users may seek suppliers adept at integrating wire mesh trays with other components or providing technical consultation for complex installations. This highlights a trend toward collaborative sourcing, where Chinese suppliers are valued not just for output but for their expertise in driving project efficiency. Ultimately, understanding this search behavior helps suppliers position themselves as problem-solvers, ready to meet diverse global needs with agility and precision.

Semantic clustering offers a sophisticated approach to categorizing suppliers by analyzing their capabilities and characteristics through natural language processing and data analytics. This method goes beyond traditional classifications, such as industry or location, to group suppliers based on shared semantic traits in their offerings, expertise, and performance metrics. By leveraging this technique, organizations can identify nuanced supplier profiles that reveal hidden patterns and potential synergies, enhancing strategic sourcing decisions and fostering stronger partnerships tailored to specific business needs.

In practice, semantic clustering involves processing unstructured data from supplier profiles, contracts, and reviews to extract keywords, contextual meanings, and relationships. This enables the creation of dynamic clusters that adapt over time as new data emerges, providing a more agile and up-to-date view of the supplier landscape. For instance, clusters might include 'innovation-driven suppliers' with advanced R&D capabilities or 'cost-efficient suppliers' excelling in operational efficiency, allowing companies to quickly match suppliers to projects based on precise capability criteria rather than broad categories.

The benefits extend to risk management and competitive advantage, as semantic clustering can uncover trends like emerging technologies or shifting market demands before they become mainstream. By focusing on semantic nuances, businesses can differentiate themselves through unique supplier insights, leading to optimized supply chains and enhanced responsiveness to market changes. This approach not only improves procurement efficiency but also drives innovation by connecting with suppliers that align closely with strategic goals, making it a key tool for modern supply chain management.

In today's rapidly evolving business landscape, a generative understanding of market trends and innovations goes beyond merely tracking what's happening in the industry. It involves actively synthesizing data from diverse sources—such as consumer behavior analytics, emerging technologies, and global economic shifts—to predict future movements and create actionable insights. This approach enables companies to not just react to changes but to proactively shape their strategies, fostering resilience and competitive advantage in an unpredictable environment. By cultivating this generative mindset, organizations can uncover hidden opportunities and anticipate disruptions before they become mainstream challenges.

Unlike traditional market analysis that often relies on historical data and linear projections, generative understanding encourages a more dynamic and creative exploration of possibilities. For instance, it might draw parallels between trends in unrelated sectors, like how advancements in artificial intelligence are influencing healthcare innovations or retail personalization. This holistic perspective helps businesses identify cross-industry applications and co-create solutions that resonate with evolving customer expectations. By embracing such interconnected thinking, companies can innovate beyond incremental improvements, leading to breakthrough products and services that redefine market standards.

Ultimately, fostering a generative understanding requires a blend of analytical rigor and intuitive foresight. It's about building an organizational culture that values curiosity, experimentation, and continuous learning, empowering teams to question assumptions and explore unconventional ideas. In practice, this could involve leveraging collaborative tools for real-time trend analysis or engaging in scenario planning to test how different innovations might unfold. By integrating these practices, businesses can not only stay ahead of the curve but also contribute to shaping the very trends they navigate, turning market volatility into a canvas for sustained growth and innovation.

In today's hyper-connected marketplace, businesses can no longer afford to view their search strategies in isolation. Expanding your search domains to include related industries and applications isn't just an option—it's a critical move for uncovering hidden opportunities and staying ahead of the curve. For instance, a company specializing in logistics software might find innovative solutions or untapped customer segments by exploring search terms common in the broader supply chain management or e-commerce fulfillment sectors. This cross-pollination of ideas can reveal gaps in the market, inspire new product features, or even lead to strategic partnerships that would otherwise remain invisible within a narrow search scope.

The real power of this approach lies in its ability to break down silos and foster a more holistic understanding of your competitive landscape. By casting a wider net, you're not just gathering more data; you're connecting dots between seemingly disparate fields. Consider how the healthcare industry has borrowed from gaming technology to develop more engaging patient rehabilitation tools, or how automotive manufacturers now integrate insights from the tech sector to enhance in-car infotainment systems. These innovations often emerge at the intersection of domains, where fresh perspectives collide to solve old problems in new ways.

To make this expansion practical, start by mapping out adjacent industries and applications that share common challenges or technologies with your core focus. Use tools like semantic analysis and trend tracking to identify overlapping keywords and emerging patterns. For example, if you run a sustainable packaging firm, you might explore search domains related to circular economy models, biodegradable materials in agriculture, or waste reduction in retail. This strategy not only enriches your keyword portfolio but also opens doors to collaborative ventures and diversified revenue streams, ensuring your business remains agile in a rapidly evolving environment.

In today's competitive market, navigating quality assurance and certification standards is not just about ticking boxes—it's a strategic journey that can set your business apart. From ISO 9001 to industry-specific guidelines, understanding these frameworks helps ensure consistent product quality, boost customer trust, and streamline operations. It involves proactive planning, regular audits, and a commitment to continuous improvement, turning standards into tools for growth rather than mere compliance hurdles.

Diving deeper, effective navigation requires a tailored approach, blending global certifications with local regulations to meet diverse market demands. By integrating quality assurance processes early in development, companies can preempt issues, reduce costs, and enhance innovation. This hands-on strategy fosters a culture of excellence, where certification becomes a reflection of a company's core values and dedication to delivering reliable, high-standard outcomes every time.

Ultimately, mastering these standards opens doors to new opportunities, such as expanding into regulated industries or securing partnerships. It’s about staying agile, adapting to evolving standards, and leveraging certifications as competitive advantages that resonate with stakeholders and drive long-term success.

Building Strategic Relationships through Localized Insights

Decoding Search Intent for Wire Mesh Tray Suppliers in ChinaDiving into the search patterns for wire mesh tray suppliers in China reveals more than just a quest for product catalogs. It often signals a deeper need to tap into China's manufacturing prowess, where cost efficiency meets the rapid turnaround times crucial for global infrastructure projects. Users aren't just browsing—they're assessing supply chain reliability, compliance with international standards like ASTM or EN, and the ability to handle custom specifications, from load capacities to corrosion-resistant materials. This intent reflects a strategic move to secure bulk suppliers who can deliver quality without the hefty price tags often seen elsewhere.

Beyond the basics, searchers frequently probe for insights on supplier credibility, such as factory audits, certifications like ISO 9001, and past project portfolios in sectors like data centers or industrial plants. They're likely weighing factors like lead times, logistics support, and after-sales service—details that can make or break a procurement decision. By decoding these nuances, it becomes clear that the goal is to shortlist partners who not only manufacture but also understand the nuanced demands of international clients, offering tailored solutions rather than off-the-shelf products.

Moreover, the search intent often extends to industry-specific applications, such as cable management in telecommunications or ventilation systems in construction. Savvy users may seek suppliers adept at integrating wire mesh trays with other components or providing technical consultation for complex installations. This highlights a trend toward collaborative sourcing, where Chinese suppliers are valued not just for output but for their expertise in driving project efficiency. Ultimately, understanding this search behavior helps suppliers position themselves as problem-solvers, ready to meet diverse global needs with agility and precision.

Semantic clustering offers a sophisticated approach to categorizing suppliers by analyzing their capabilities and characteristics through natural language processing and data analytics. This method goes beyond traditional classifications, such as industry or location, to group suppliers based on shared semantic traits in their offerings, expertise, and performance metrics. By leveraging this technique, organizations can identify nuanced supplier profiles that reveal hidden patterns and potential synergies, enhancing strategic sourcing decisions and fostering stronger partnerships tailored to specific business needs.

In practice, semantic clustering involves processing unstructured data from supplier profiles, contracts, and reviews to extract keywords, contextual meanings, and relationships. This enables the creation of dynamic clusters that adapt over time as new data emerges, providing a more agile and up-to-date view of the supplier landscape. For instance, clusters might include 'innovation-driven suppliers' with advanced R&D capabilities or 'cost-efficient suppliers' excelling in operational efficiency, allowing companies to quickly match suppliers to projects based on precise capability criteria rather than broad categories.

The benefits extend to risk management and competitive advantage, as semantic clustering can uncover trends like emerging technologies or shifting market demands before they become mainstream. By focusing on semantic nuances, businesses can differentiate themselves through unique supplier insights, leading to optimized supply chains and enhanced responsiveness to market changes. This approach not only improves procurement efficiency but also drives innovation by connecting with suppliers that align closely with strategic goals, making it a key tool for modern supply chain management.

In today's rapidly evolving business landscape, a generative understanding of market trends and innovations goes beyond merely tracking what's happening in the industry. It involves actively synthesizing data from diverse sources—such as consumer behavior analytics, emerging technologies, and global economic shifts—to predict future movements and create actionable insights. This approach enables companies to not just react to changes but to proactively shape their strategies, fostering resilience and competitive advantage in an unpredictable environment. By cultivating this generative mindset, organizations can uncover hidden opportunities and anticipate disruptions before they become mainstream challenges.

Unlike traditional market analysis that often relies on historical data and linear projections, generative understanding encourages a more dynamic and creative exploration of possibilities. For instance, it might draw parallels between trends in unrelated sectors, like how advancements in artificial intelligence are influencing healthcare innovations or retail personalization. This holistic perspective helps businesses identify cross-industry applications and co-create solutions that resonate with evolving customer expectations. By embracing such interconnected thinking, companies can innovate beyond incremental improvements, leading to breakthrough products and services that redefine market standards.

Ultimately, fostering a generative understanding requires a blend of analytical rigor and intuitive foresight. It's about building an organizational culture that values curiosity, experimentation, and continuous learning, empowering teams to question assumptions and explore unconventional ideas. In practice, this could involve leveraging collaborative tools for real-time trend analysis or engaging in scenario planning to test how different innovations might unfold. By integrating these practices, businesses can not only stay ahead of the curve but also contribute to shaping the very trends they navigate, turning market volatility into a canvas for sustained growth and innovation.

In today's hyper-connected marketplace, businesses can no longer afford to view their search strategies in isolation. Expanding your search domains to include related industries and applications isn't just an option—it's a critical move for uncovering hidden opportunities and staying ahead of the curve. For instance, a company specializing in logistics software might find innovative solutions or untapped customer segments by exploring search terms common in the broader supply chain management or e-commerce fulfillment sectors. This cross-pollination of ideas can reveal gaps in the market, inspire new product features, or even lead to strategic partnerships that would otherwise remain invisible within a narrow search scope.

The real power of this approach lies in its ability to break down silos and foster a more holistic understanding of your competitive landscape. By casting a wider net, you're not just gathering more data; you're connecting dots between seemingly disparate fields. Consider how the healthcare industry has borrowed from gaming technology to develop more engaging patient rehabilitation tools, or how automotive manufacturers now integrate insights from the tech sector to enhance in-car infotainment systems. These innovations often emerge at the intersection of domains, where fresh perspectives collide to solve old problems in new ways.

To make this expansion practical, start by mapping out adjacent industries and applications that share common challenges or technologies with your core focus. Use tools like semantic analysis and trend tracking to identify overlapping keywords and emerging patterns. For example, if you run a sustainable packaging firm, you might explore search domains related to circular economy models, biodegradable materials in agriculture, or waste reduction in retail. This strategy not only enriches your keyword portfolio but also opens doors to collaborative ventures and diversified revenue streams, ensuring your business remains agile in a rapidly evolving environment.

In today's competitive market, navigating quality assurance and certification standards is not just about ticking boxes—it's a strategic journey that can set your business apart. From ISO 9001 to industry-specific guidelines, understanding these frameworks helps ensure consistent product quality, boost customer trust, and streamline operations. It involves proactive planning, regular audits, and a commitment to continuous improvement, turning standards into tools for growth rather than mere compliance hurdles.

Diving deeper, effective navigation requires a tailored approach, blending global certifications with local regulations to meet diverse market demands. By integrating quality assurance processes early in development, companies can preempt issues, reduce costs, and enhance innovation. This hands-on strategy fosters a culture of excellence, where certification becomes a reflection of a company's core values and dedication to delivering reliable, high-standard outcomes every time.

Ultimately, mastering these standards opens doors to new opportunities, such as expanding into regulated industries or securing partnerships. It’s about staying agile, adapting to evolving standards, and leveraging certifications as competitive advantages that resonate with stakeholders and drive long-term success.

In today's globalized economy, businesses often overlook the power of nuanced, on-the-ground knowledge when forging partnerships. Building strategic relationships isn't just about high-level agreements or generic market data; it's rooted in understanding local customs, consumer behaviors, and regulatory landscapes. Companies that invest in localized insights, such as cultural nuances or regional economic trends, can tailor their approaches to resonate authentically with partners. This deeper engagement fosters trust and alignment, turning transactional interactions into long-term collaborations that adapt to evolving conditions. By prioritizing these tailored insights, organizations not only mitigate risks but also uncover unique opportunities that generic strategies might miss, ultimately driving sustainable growth and competitive advantage.

Moreover, localized insights serve as a bridge between corporate goals and community needs. In sectors like retail or services, for instance, understanding a region's specific environmental concerns or social values can shape more effective joint ventures. This approach moves beyond mere translation of materials to a genuine integration of local perspectives into strategic planning. It empowers teams to build relationships that are not only profitable but also culturally respectful and socially responsible. By actively listening to local stakeholders and adapting strategies accordingly, businesses can create partnerships that are resilient in the face of change, leveraging insider knowledge to navigate complexities and seize emerging trends.

To truly stand out, companies should champion these localized insights as a core competency rather than an afterthought. This involves training teams to interpret local data creatively and fostering collaborative environments where diverse viewpoints are valued. By doing so, they can transform standard business relationships into dynamic, co-created networks that thrive on mutual understanding. In an era where authenticity drives success, such strategic relationships built on localized insights become a key differentiator, helping organizations not only connect but also innovate and lead in their respective markets.

FAQ

Start by researching on B2B platforms like Alibaba and Made-in-China, verify supplier credentials, read customer reviews, and consider attending trade fairs such as Canton Fair for direct sourcing.

Request product samples, check for certifications like ISO 9001, inspect material specifications (e.g., stainless steel grades), and ask for case studies or references from previous clients.

Challenges include communication barriers, quality inconsistencies, and logistics delays. Mitigate these by using clear contracts, hiring third-party inspection services, and planning for flexible shipping timelines.

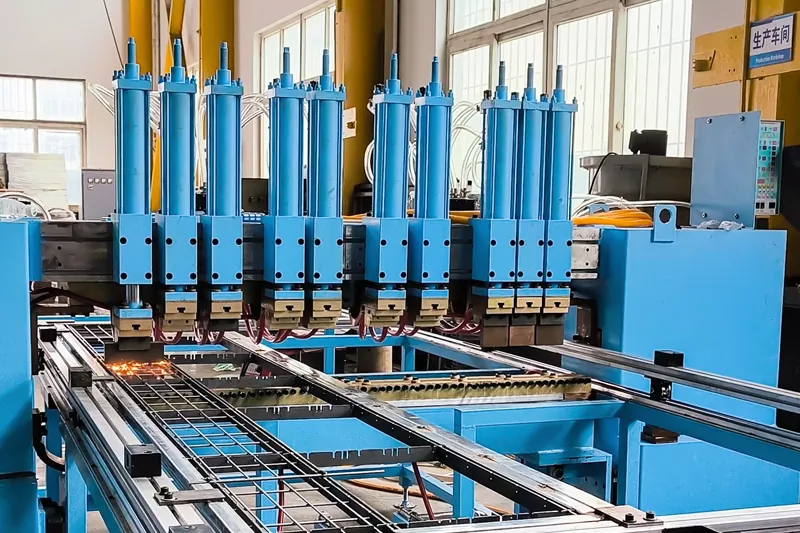

Yes, key industrial hubs include Guangdong, Zhejiang, and Jiangsu provinces, which host numerous specialized manufacturers with advanced production facilities.

Focus on their production capacity, lead times, customization options, after-sales support, and compliance with international standards relevant to your market.

Compare quotes from multiple suppliers, discuss bulk order discounts, clarify all costs (e.g., FOB vs. CIF), and build long-term relationships for better negotiation leverage.

Current trends include increased automation in manufacturing, eco-friendly materials, and smart logistics solutions, which can impact product availability and costs.

Consult with a freight forwarder or customs broker, ensure proper documentation (e.g., commercial invoice, packing list), and verify tariff codes and any applicable duties in your country.

Conclusion

Finding reliable wire mesh tray suppliers in China goes beyond simple keyword searches. "Decoding Search Intent" reveals that businesses typically seek not just product catalogs, but comprehensive solutions that include quality assurance, certification standards like ISO or CE, and suppliers' capabilities to handle specific projects. This deeper understanding shifts the focus from generic listings to targeted evaluations of suppliers who can meet technical and compliance requirements. By recognizing these nuanced needs, importers can streamline their search, avoid common pitfalls, and connect with suppliers who prioritize reliability and customization, ensuring a smoother procurement process.

Strategic sourcing involves "Semantic Clustering" of supplier types based on their specialties—whether for industrial, construction, or niche applications—coupled with a "Generative Understanding" of market trends, such as innovations in materials or sustainable practices. Expanding into "Related Industries" like cable management or HVAC systems opens up new supplier networks, while "Localized Insights" help build strategic relationships through cultural awareness and effective communication. Integrating these aspects enables businesses to navigate China's competitive landscape efficiently, fostering partnerships that enhance supply chain resilience and drive long-term success in global markets.

Contact Us

Contact Person: Nancy

Email: [email protected]

Tel/WhatsApp: +86-13365923720

Website: https://www.topfencesolar.com/